In any organization, you hear the same observations:

- “We’re making progress, but too slowly.”

- “The teams are overloaded.”

- “We spend all our time refocusing.”

- “We work hard… but we don’t see the results.”

Everyone feels that something is wrong. But as long as this loss of performance remains intangible, it is invisible in the accounts. And what is not measured is… automatically underestimated.

However, all organizations pay a very high price for their governance failures. This cost, which is diffuse but massive, has a name: the Cost of Poor Governance (CoPG). And when we start to measure it, we discover a disturbing reality: what we thought were “normal minor inefficiencies” often represent hundreds of thousands of euros, sometimes several million.

Poor Governance: The hidden cost that weighs down organizations

In an organization, no one wakes up in the morning with the intention of slowing down a project. Everyone works hard, does their best, adapts, improvises, and compensates. So the problem is never a lack of commitment.

The problem is structural:

- Changing priorities;

- Pending decisions;

- Sponsors who fail to make decisions;

- Poorly defined projects;

- Resources spread too thinly across too many fronts;

- Committees that fail to reach decisions;

- Poor information flow;

- A proliferation of “shadow” projects.

These dysfunctions generate a form of invisible underperformance. And the collective illusion is to believe that “it just wastes a little time.”

In reality, this represents:

- Cumulative delays of several weeks,

- A dispersion of resources across 20 to 30% of non-priority projects,

- An internal inefficiency rate often exceeding 20%,

- A loss of focus that fragments the entire organization.

No one sees these losses in the income statement. But they do exist, and they add up.

The analogy with the Cost of Poor Quality

In the 1980s and 1990s, industry experienced exactly the same phenomenon. Teams thought that “doing things right” was expensive. Then they discovered that what was really expensive…

These are:

- Scrap,

- Delays,

- Defects,

- Re-work.

This invisible waste has been theorized under the name Cost of Poor Quality (COPQ). And as soon as we start to measure it, a profound transformation began.

Today, project governance is undergoing the same transformation: the problem is not doing more, but stopping the loss of value due to a lack of management. The Cost of Poor Governance (CoPG) is to management what COPQ is to quality.

CoPG definition: the cost of lost value

The CoPG measures the value that the organization could have created but failed to achieve due to:

- A lack of prioritization,

- Slow decision-making,

- Insufficient scoping,

- Misaligned projects,

- Poor load/capacity,

- Delays in execution,

- Insufficiently structured governance.

It is generally calculated by adding the following three components.

1Internal inefficiency cost (C1)

This refers to unproductive time: meetings without decisions, rework, follow-ups, double processing, searching for information, waiting for arbitration, etc. These micro-waste factors, multiplied by dozens of teams, become a massive cost.

Formula:Payroll dedicated to initiatives × % of unproductive time

Example: 100 people devote 20% of their time to projects, 25% of which has no added value:

100 × 0.20 × 0.25 =5 FTEs lost

At $80,000/FTE, that’s $400,000 per year down the drain.

2Cost of delays (C2)

Every month of delay on a project generating recurring revenue is a month of lost revenue. A project that is three months behind schedule? That’s 25% of its annual revenue lost this year.

Formula:Annual recurring revenues × (delay in months / 12)

Example: $1 million in expected revenues represents approximately $83,000 in unrealized monthly revenues.

An average delay of 2 months corresponds to $160,000 in lost value.

3Cost of strategic misalignment (C3)

These are “shadow projects”:

- Unapproved,

- Non-priority,

- Outside governance,

- Poorly aligned,

- Driven by isolated sponsors,

- Or poorly defined.

They consume budget… without creating value.

Formula:Payroll dedicated to initiatives × % of initiatives not aligned

Example: With a project budget of $1 million, a 20% misalignment equates to $200,000 in resources not being used for the intended purpose.

Benchmarks show: a massive and widespread problem

The figures speak for themselves:

- McKinsey: Organizations with mature governance generate 30% more value.

- PMI: Organizations with weak governance lose 11.4% of their project investment.

- Gartner: 20 to 30% of project time is absorbed by non-value activities (rework, waiting, dispersion).

In practice: for every million invested in projects, between $100,000 and $300,000 is wasted due to a lack of clear governance. This is exactly what the CoPG measures.

Measuring your CoPG, the turning point of your performance

Most senior management teams underestimate the impact of poor governance. They see the symptoms — overwork, delays, loss of focus — but not their true cost. The CoPG provides a fundamental breakthrough: it transforms intuition (“we’re wasting time”) into a quantified demonstration (“we’re losing $1.4 million per year due to poor governance”).

Here’s what organizations discover when they calculate their CoPG for the first time.

Internal inefficiency is always higher than we think

Between hunting for information, meetings without decisions, rework, poorly defined projects, etc., unproductive time often exceeds 20 to 30% of project time. This is not the fault of the teams: it is a sign of insufficiently structured governance.

Delays in decision-making cost more than technical delays

A project may be perfectly executed by the teams… but remain stuck for three weeks awaiting approval. These “minor” delayed decisions sometimes cost more than delays in the field.

10 to 30% of the portfolio consists of shadow projects

Organizations are realizing that they are funding projects that are:

- Outside their priorities,

- Poorly defined,

- Driven by a single sponsor,

- Invisible in dashboards.

This simple cleanup immediately frees up resources.

Interpreting the CoPG: Two ratios that speak to executives

For senior management to immediately understand the scope of the CoPG, it simply needs to be compared to two simple benchmarks:

1Ratio 1: CoPG / Project payroll

It measures the proportion of wasted human resources.

| Waste of human resources | Interpretation |

|---|---|

| Less than 20% | Safe zone |

| 20–40% | Governance could be improved |

| 40% | Major loss of resources |

| 60% or greater | Organizational fracture |

2Ratio 2: CoPG / Recurring earnings

It measures whether the organization creates… or destroys value.

| Value creation/destruction rate | Interpretation |

|---|---|

| Less than 30% | Limited impact |

| 30–80% | Major obstacle to value creation |

| 100% | The organization loses more than it gains |

| 150% | Total governance breakdown |

CoPG: A strategic indicator reserved for C-level executives

Operational teams have a multitude of indicators at their disposal: workload, progress, velocity, costs, deliverables, quality, risks, etc. But C-level executives sorely lack cross-functional indicators that focus on overall performance rather than just operational performance. CoPG fills this gap.

It links:

- Governance,

- Prioritization,

- Decision quality,

- Strategic alignment,

- Transformation capacity, …

… to their concrete economic impact.

It therefore becomes a strategic management indicator, just like:

- NPS for customer satisfaction,

- TCO for financial performance,

- COPQ for industrial quality.

The CoPG is the first non-financial indicator that speaks directly to the executives.

Three immediate levers to massively reduce the CoPG

1Centralize portfolio management

A single space where priorities, trade-offs, progress, and decisions converge. This point alone already reduces a significant amount of dispersion.

2Tooling up governance

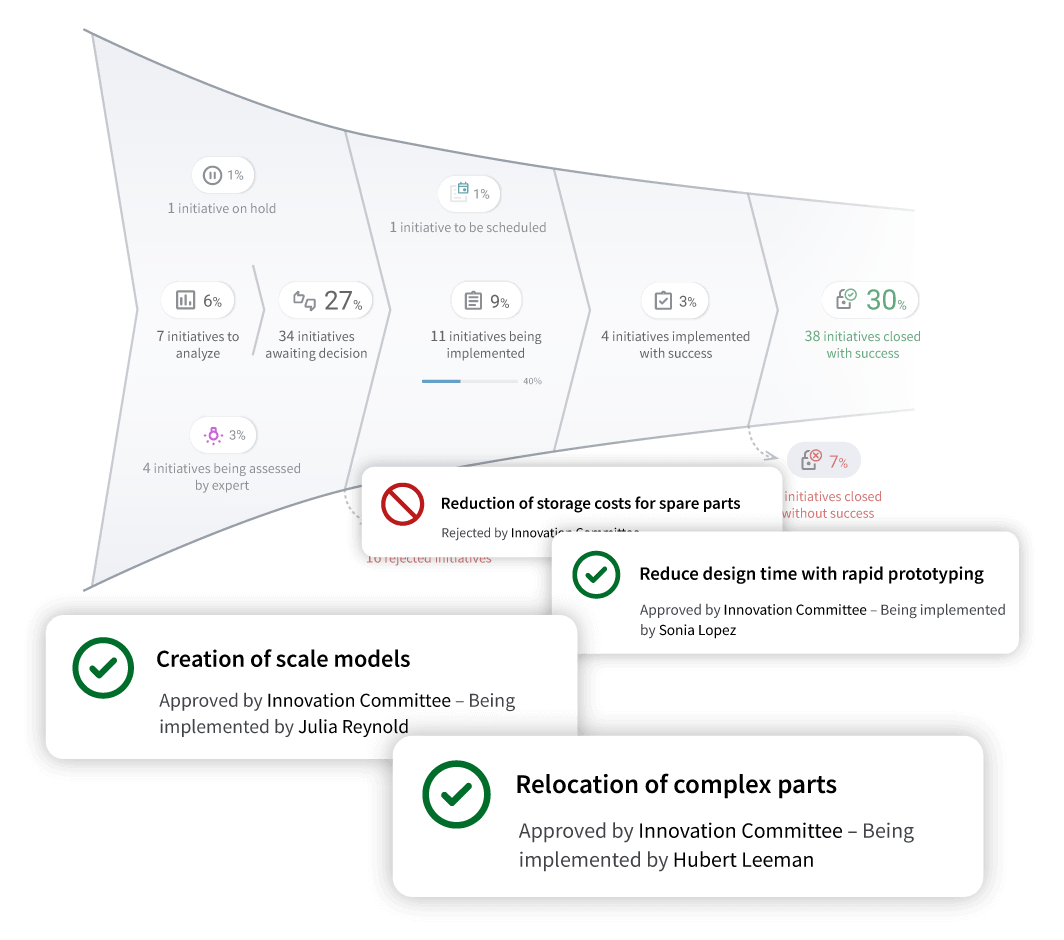

A solution such as IDhall makes it possible to:

- Make all initiatives visible,

- Eliminate shadow projects,

- Streamline decisions,

- Systematically frame projects,

- Maintain prioritization over time.

3Establish short, regular arbitration rituals

Committees should be:

- Frequent,

- Short,

- Decision-oriented,

- With cross-functional visibility.

Every week gained is value captured rather than deferred.

The CoPG: an essential lagging indicator… but not sufficient

The CoPG measures value that has already been lost. It is a lagging indicator, like an annual balance sheet.

To prevent the CoPG from recurring year after year, it must be supplemented by leading indicators, such as:

- % of projects updated,

- Average arbitration time,

- Complete scoping rate,

- Frequency of committee meetings,

- Proportion of priority vs. opportunistic projects,

- Quality of management data.

These are the vital signs that enable a sustainable reduction in CoPG.

The urgent need for action by all senior management

CoPG is not a “minor issue.” It constitutes:

- An obstacle to transformation,

- A slow destruction of value,

- A sign of chronic overload,

- An obstacle to strategic execution.

But above all, it is a recurring cost, year after year, as long as nothing is structured.

Where managers see a problem of operational efficiency, CoPG reveals a problem of overall performance. And when it is quantified — $1.4 million, $2.8 million, $4.5 million per year — it becomes impossible to ignore.

Key takeaways

The CoPG transforms intuition into evidence. All organizations feel that they are wasting time. But as long as this loss remains intangible, nothing really changes.

CoPG radically changes the game: it finally puts a number on a massive loss of value.

It is an indicator that:

- makes the invisible tangible,

- demonstrates recoverable value,

- helps prioritize,

- justifies governance investments,

- aligns teams,

- accelerates transformation.

Goodwill is no longer enough. Only structured, equipped, and managed governance can reduce these losses in the long term. Measuring CoPG means regaining control. Reducing it means unlocking organizational power that has been underutilized until now.

FAQ — Cost of Poor Governance (CoPG)

What is the Cost of Poor Governance (CoPG)?

The CoPG represents the value that the organization loses each year due to governance failures: : poor prioritization, delayed decisions, poorly defined projects, scattered resources, shadow projects, etc… It is the equivalent, for governance, of the Cost of Poor Quality in industry.

Why do we talk about “hidden costs”?

Because these losses do not appear in any budget and are not measured in any operational dashboard. They manifest themselves in:

- delays,

- rework,

- unproductive meetings,

- resources committed to non-priority projects,

- a loss of organizational focus.

Individually, they seem minor. Cumulatively, they represent hundreds of thousands or even millions of dollars in lost revenue.

How is CoPG comparable to the Cost of Poor Quality (COPQ)?

As with COPQ:

- the organization believes that “better management” is expensive,

- when in fact what is really expensive … are governance failures.

Measuring CoPG reveals massive losses in value, just as COPQ revealed industrial waste in the 1980s and 1990s.

How is CoPG measured?

CoPG is calculated based on three components:

- The cost of internal inefficiency: unproductive time, meetings without decisions, follow-ups, searching for information, rework, etc.…

- The cost of delays: every month of delay on a project that generates profits is a month of lost profits.

- The cost of strategic misalignment: shadow projects, non-priority or non-governance initiatives that consume resources without creating value.

What orders of scale are observed in organizations?

International benchmarks are unanimous:

- +20 to +30% value for organizations with mature governance (McKinsey)

- 11.4% project losses for weak governance (PMI)

- 20 to 30% of project time absorbed by non-value (Gartner)

In practice: for every $1 million invested in projects, $100,000 to $300,000 is wasted.

Why do executives underestimate CoPG?

Because the symptoms are visible (delays, overload, frustration, loss of focus) but not their real cost. Measuring CoPG transforms intuition (“we’re wasting time”) into a strong signal (“we’re losing $1.4 million per year due to a lack of governance”).

What are the typical symptoms of high CoPG?

- Pending decisions,

- Poorly defined projects,

- Non-priority initiatives,

- Sponsors who fail to make decisions,

- Scattered resources,

- Poor information flow,

- Committees that fail to make decisions,

- 10 to 30% of projects are shadow projects,

- 20 to 40% of time is unproductive.

The key is to ensure consistent management and a clear understanding of roles by all stakeholders.

How should CoPG be interpreted? Which ratios should be used?

Ratio 1: CoPG / Project payroll

- < 20%: safe

- 20–40%: governance could be improved

- 40–60%: major loss

- 60%: organizational divide

Ratio 2: CoPG / Recurring earnings

- < 30%: limited impact

- 30–80%: major obstacle

- 100%: the organization loses more than it gains

- 150%: poor governance

Why is CoPG a KPI for the executives, and not just for operational teams?

Because it directly links:

- governance,

- prioritization,

- decision quality,

- transformation capacity,

… to their economic impact.

CoPG is a cross-functional KPI that can be understood instantly by executives. It is the counterpart to NPS, TCO, and COPQ.

How can you quickly reduce the CoPG?

- Centralize portfolio management

A single space for priorities, trade-offs, progress, and decisions.

- Tool up governance

Avec une solution comme IDhall, vous pouvez tout rendre visible « de la cave au grenier », éliminer les projets fantômes, cadrer systématiquement les projets, fluidifier les décisions et maintenir la priorisation dans le temps.

- Installer des rituels courts et réguliers d’arbitrage

Comités fréquents, courts, orientés décision, avec une vision transverse.

Is the CoPG sufficient to drive performance?

No: it is a lagging indicator. To take action, it must be supplemented by leading indicators, such as:

- average arbitration time,

- complete alignment rate,

- % of projects updated,

- frequency of committee meetings,

- quality of data management,

- proportion of priority vs. opportunistic projects.

Why should corporate executives act now?

Because CoPG:

- slows down transformation,

- destroys value,

- overloads teams,

- slows down strategic execution,

- and repeats itself every year until something is done about it.

Measuring it means making the invisible visible. Reducing it means unlocking massive performance potential.

What is the link between CoPG and IDhall?

IDhall helps to reduce and prevent the cost of poor governance in the long term through:

- cross-functional visibility of all initiatives,

- centralization of the portfolio,

- systematic scoping,

- continuous prioritization,

- steering rituals,

- elimination of shadow projects.